Project Gallery

Here are some projects I worked on

Design Sprint for Superannuation to Pension Transition

Project Overview

MLC faced a challenge with customers transitioning from superannuation to pension products. The complexity of MLC's process led to a high attrition rate, with many customers switching to competitors like Australian Super. This project aimed to simplify the transition process, improving customer retention and satisfaction.

Outflows from customers aged 50+ without financial advisers were a growing business concern.

My ROLE

As the Head of Experience Design, I led a multidisciplinary team including a service designer, a commercial viability specialist, and representatives from the contact centre, sales team, product, and technology.

DISCOVERY PHASE

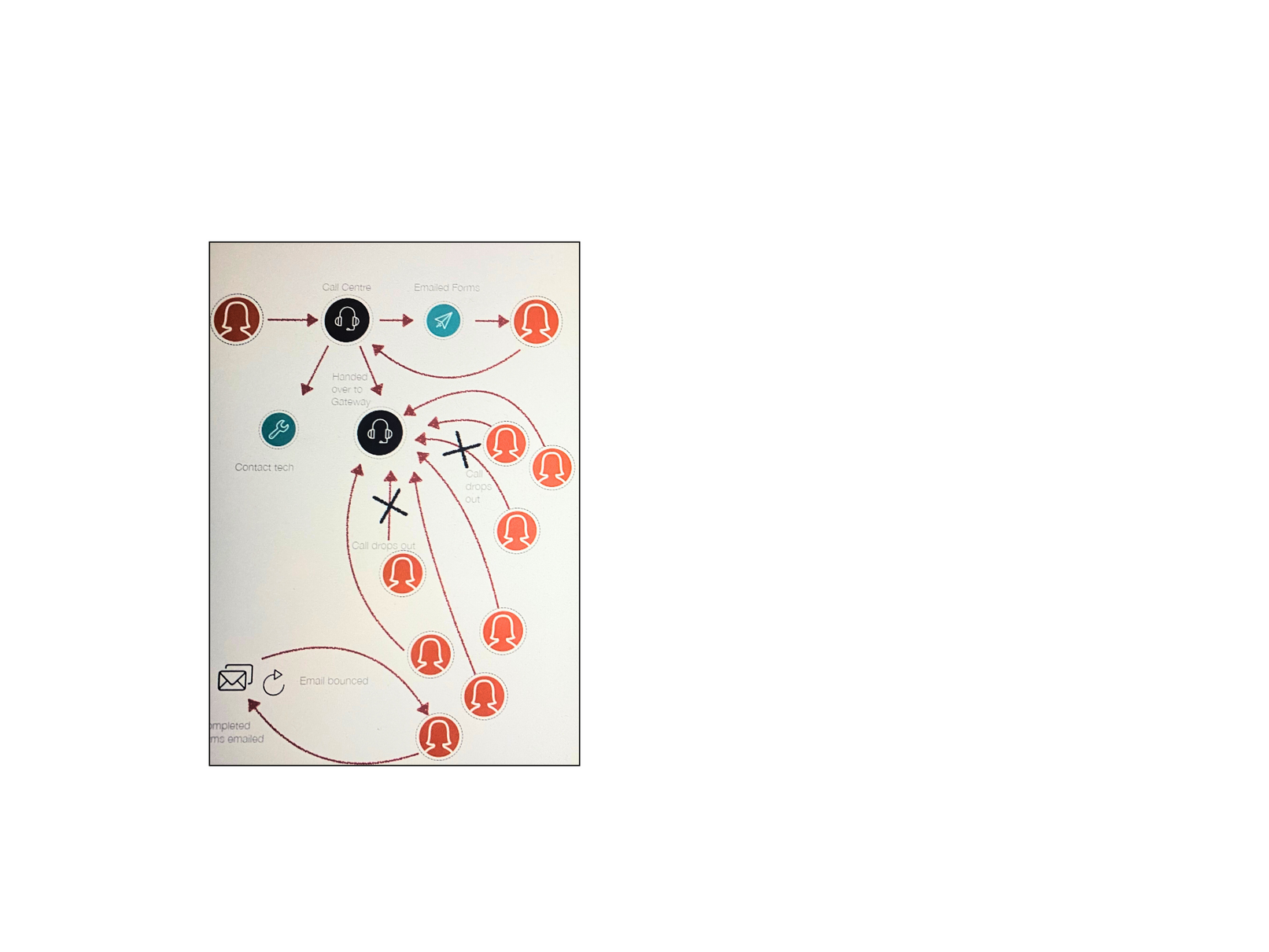

Our initial research included:

- Mystery shopping calls to competitors, revealing a simpler experience with them.

- Mapping customer journeys, highlighting pain points like long phone interactions, complex paperwork, and confusing investment choices.

KEY CUSTOMER INSIghts

This is my life’s savings, I’ll never earn another dollar.

Are you making this tricky for me on purpose?

I’m terrified of making a mistake

Design Sprint Methodology

We conducted a 5-day Design Sprint involving Experience Design, Call Centre, Technology, Product, Viability & Phone Advice teams.

Day 1

Understand

Day 2

Ideate

Day 3

Decide

Day 1

Understand

Day 4

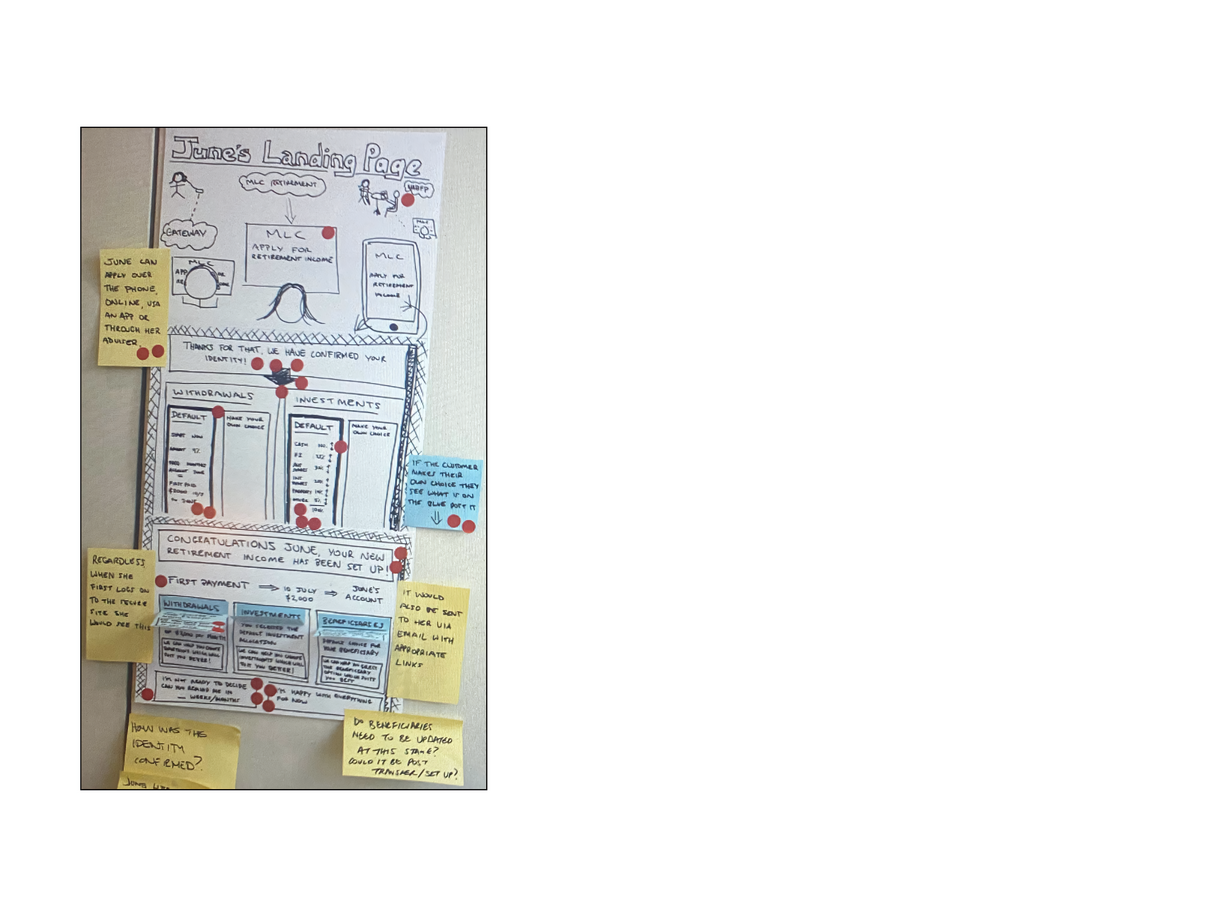

Prototype

Day 5

Test

Features Tested

Lessons Learned

- Phone-Based Application Completion

- Pre-Populated Customer Details

- Instant Identity Verification

- Two-Factor Verification

- Default Drawdown Strategy

- Default Investment Option

- Ported Beneficiary Details

- Intra-Fund Advice (Failed)

- Flat structure accelerated decisions.

- Cross-team collaboration improved.

- Early customer testing is a game changer.

Impact

Our solution provided a roadmap to streamline the pension transition process, enhancing customer satisfaction and retention.

North Star Concept: Seamless Start-Up

Project Overview

The customer journey programme was introduced as a new delivery model within NAB, focusing on customer-led and Agile methodologies. At the time, I was leading the Experience Design Team within NAB's Superannuation division, MLC. This programme represented a significant shift for the bank, aiming to deliver change more effectively and customer-focused.

My ROLE

As the Head of Digital Experience, I played a crucial role in mapping and the customer journey, ideating and validating concepts, working closely with internal stakeholders and BCG Digital consultants.

DISCOVERY PHASE

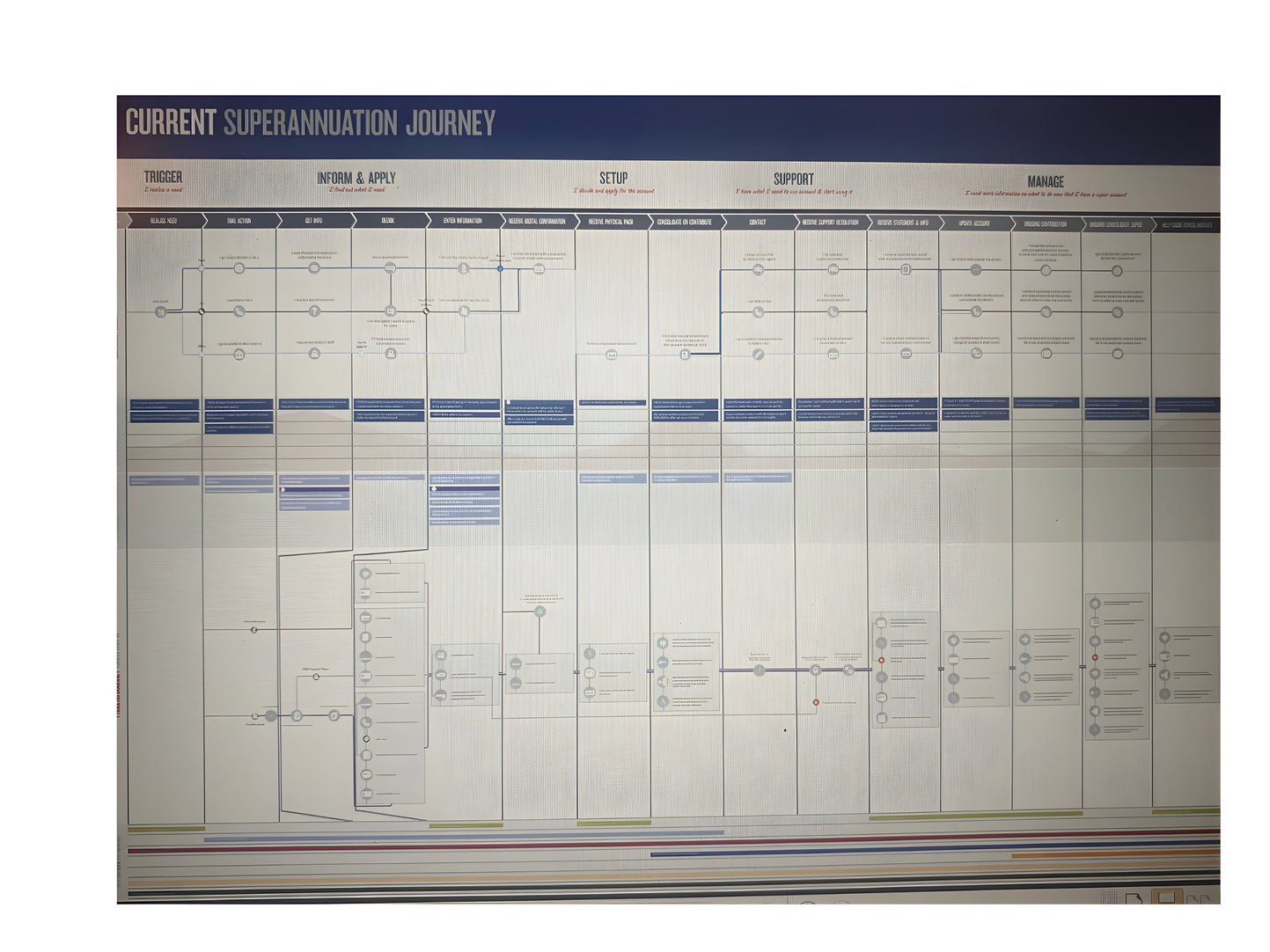

We established seven customer journeys across the bank, with MLC being one of the two pilot journeys.

Our MLC persona 'Bec,' a 30-year-old with low engagement in her superannuation savings and multiple low-balance accounts, served as the focus.

Baseline Journey mapping

Entire customer lifecycle mapped for all channels

KEY CUSTOMER INSIghts

I really should be on top of my superannuation; however, it has not made my priority list to address.

I find the application process time-consuming and complicated with too many options.

Even if I was to engage with my superannuation, I’m not sure what I’m supposed to do to get it in order.

After I signed up with MLC, no one from MLC follows up with me around my account.

IDEATION and TESTING

With baseline customer input, funding opportunities, and the chance to lead ideation for the future state, concepts were developed and tested with customers. As digital solutions emerged as a preference, my role evolved to include leading the digital teams within the Customer Journey programme.

CONCEPTS DEveloped

- Simplified online sales form with a streamlined investment menu

- Personalised 'Next Actions' to-do list displayed upon login

- Consolidating other super accounts into the MLC account

- Notify their employer of their MLC account

- Nominating beneficiaries

- Progress bar

- One-click application from NAB Internet Banking

- Straight-through processing to authenticated exit

Lessons learned

Many of these ideas were previously explored within the Sales and Optimisation team but were parked due to lack of funding. The opportunity to connect them with broader customer mapping, insights and funding allowed for their realisation.

Impact

MVP 1 of Seamless Start-Up became the most commercially successful North Star concept across the seven journeys, delivering a $117M Year-on-Year increase in fund inflows via the Digital Channel